Introduction:

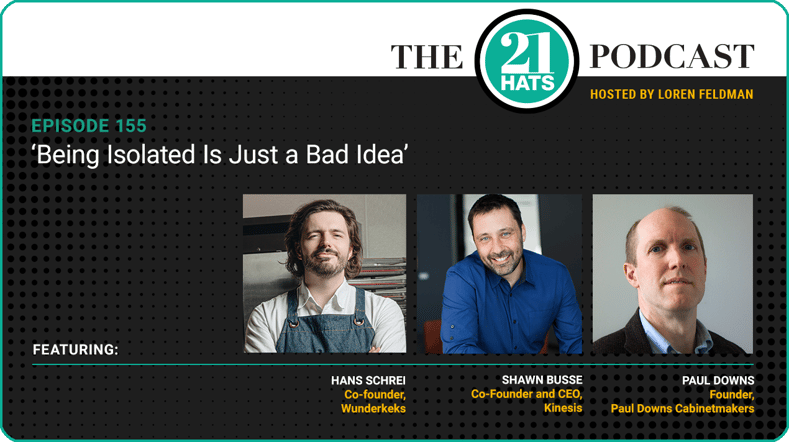

This week, Hans Schrei and Shawn Busse talk about why they put their businesses through accelerators, and Paul Downs explains why he might have done the same thing if accelerators had existed back when he started his business—”although,” he says, “I was probably too dumb to realize the value of it.” Hans, who just completed a 13-week accelerator program with his partner, Luis, also tells us how Wunderkeks fared while he and Luis were in the program, what they got out of it, and why they felt it was worth giving up the equity that was the price of admission. Plus: why Shawn went to an employee’s college graduation and how Paul managed to take a vacation. Oh, and Paul also talks about what surprised him about the recent 21 Hats event in Chicago.

— Loren Feldman

This content was produced by 21 Hats.

See Full Show Notes By 21 Hats

Podcast Transcript

Loren Feldman:

Welcome Shawn, Paul, and Hans. I appreciate you taking the time. I want to start today with Hans. Hans, you’ve been busy lately, putting your cookie company through, I gather, a consumer packaged goods accelerator in Austin. I believe it’s called SKU. Can you tell us about it?

Hans Schrei:

Yeah, sure. It’s been 13 weeks, and it was a lot to handle, but basically, the purpose was, there was an insane amount of opportunities coming our way. And a lot of the time, we were not prepared. Our first impulse was to say, “Yes,” and we’ll figure it out later. But at some point, we realized—and I’m very grateful that we did this. I don’t know what miracle happened—but we said, “You know what? We don’t really have the capabilities right now. We need to build them before we actually go and tackle the Costcos and the Targets of the world.”

So that’s what we’ve been doing, and it was a very challenging experience. This accelerator is called SKU. It works on a mentorship model. So you get assigned a ton of mentors, and we have a team. We got access to a large network of CPG professionals. And they all come from different disciplines, and from the different parts of the corporate experience. So there were entrepreneurs and finance people and big, big companies, big CPG people. They run the gamut: investors, people in PR.

And it was very interesting to really get to talk to people in every single corner of the world of CPG. And to understand their perspective, because I think that what happens as a founder is that you’re a founder, your friends are founders, the people you talk to all day are founders. And it’s very easy to lose track of the stakeholders. Because down the line, you’re gonna have to manage all of these people. And it’s very useful to understand how they think and what they see that you don’t. So it was, frankly, very enlightening.

Loren Feldman:

Did you have to go through an application process?

Hans Schrei:

Yes, from what I understand there were 800 applicants. It’s actually the second time that we applied to this accelerator. So we ended up being down to six companies. And then we had to pitch, which was kind of intimidating, because I was expecting to pitch to three people, and it was 30 who were on that call, a lot of very intimidating people. So yeah, it was a whole process. At the end of the day, I think that what really worked in our favor was that we had the ability to convey what the larger purpose of what we’re doing is, and what we needed out of the accelerator.

Loren Feldman:

Did you and your partner Luis both go through the experience?

Hans Schrei:

Yeah.

Loren Feldman:

Did I hear you say that there were six companies whose applications were accepted and participated?

Hans Schrei:

Yes, it was six.

Loren Feldman:

And 13 weeks. Can you give us a sense of: What was a typical day like?

Hans Schrei:

Basically, everyone has their team of mentors. You have a lead mentor, and you have a team of eight people. And then you have access to all of the others. So in total it was like 70. And there was a weekly call, like, “Okay, so this is where we are, this is where we need to establish priorities and then move onto the next thing.” So a weekly check-in with everyone, and then you got to work on the individual parts of it with different teams. So if you were looking at the marketing part, you went to the marketing people. If you wanted finance, you went to the finance people. And you got to talk to whoever you wanted, and everyone was extremely willing to help.

And then there were classes, which, at first I felt like, “I don’t really need this. I went through this already. I know this.” But as they progressed, I realized that it was very useful. Even things as silly as—well, not silly—but things that you take for granted, like doing a P&L. There’s some nuance and some things that you want to see. Yeah, sure, I can do a P&L. But it’s a very different thing to do a P&L that is going to convey the information that investors need, for instance, or that is going to convey the information that the buyer is going to need. So that was very enriching to go back to all of these things from the lens of a startup.

Loren Feldman:

Paul, Shawn, if you guys have questions as we go, please feel free to jump in.

Paul Downs:

I do have a question. So you said there were 800 applicants and six chosen. Did you get a sense for the level of viability that you had to demonstrate in order to be considered?

Hans Schrei:

I’m not sure that we talked about this explicitly, but I think what they were looking for, for the most part, was some traction and also the potential. Because there are a lot of ideas that are very—in CPG, particularly—a lot of them are kind of niche. So if you’re doing something that is very small, that doesn’t really have the possibility to really grow, it probably doesn’t make sense. Because the whole idea here is these are companies that are being built to scale. And sometimes—and I think this is something that was not made explicit—but my conclusion was: That is where the difference between a small business and a startup lies. Is this really scalable?

I heard about a few examples that were companies that were solid businesses and were making money but were working in categories where it was not really realistic to expect them to grow into national brands. So I’m guessing that that potential was important. And from what I gather, it was very relevant also that the founders were coachable. Because that’s something that happens a lot. And for us, frankly, a year ago, I don’t think we would have been the best candidates. Because it took us a lot of time to recognize what our shortcomings were. So we’re at a position where, “Okay, we are asking for help. We’re looking for help, and we know exactly what help we need.”

Paul Downs:

I think it’s really interesting you use the word coachable, which is a word I haven’t used since I coached kids playing soccer, but I think that is a pretty critical indicator of potential success for any business person. But I’m curious what you think the definition of that is.

Hans Schrei:

The way I see it is having this appreciation of your strengths and weaknesses. Because what’s gonna happen, for the most part, is that you’re gonna realize—and this is where we find ourselves—what took you this far as a founder is not necessarily what is gonna take you the rest of the way. But if you want to grow a company into a national or international brand, then that means we’re going to have to find the very, very, very clear-headed expert on branding, the expert on finance, the expert on logistics, instead of thinking that you know everything. So it is a process. At some point, you realize that your role within the company needs to change.

Paul Downs:

Who was funding this? Why are they doing this? Do they want to take a position in your company?

Hans Schrei:

They take a little equity in the company. And the mentors, they make a small investment into the accelerator, like they pay a fee. I’m not sure how much it is. I know that it’s something significant. So I guess they do have skin in the game. And the equity gets distributed between the accelerator itself and the mentors. So down the line, it ends up being a tiny, tiny piece of equity, but there’s some upside for them.

Shawn Busse:

What’s a tiny, tiny piece of equity look like?

Hans Schrei:

I cannot say that, because every deal is under an NDA.

Shawn Busse:

Oh, so they negotiate with each individual accelerator member on a one-to-one basis?

Hans Schrei:

That is my understanding. Frankly, I don’t know. But I do know that it is under an NDA. I mean, it’s a small piece. I’ll tell you, it’s under 10 percent of the equity. And it gets distributed to between 60 or 70 people. So it’s a tiny, tiny sliver for each.

Loren Feldman:

Tiny for them, but significant for you. Did you have any second thoughts about whether it would be worth that kind of equity?

Hans Schrei:

Yeah, for sure. Once we were accepted, we had to go and ask questions to people who have gone through it—people who were a part of it that we knew, people who had considered being a part of it but said no. And to see: Is this worth it for us? And it was a hard decision. And frankly, we kept them on pins and needles for a while because we couldn’t really make up our minds. But all things said, I’m glad that we did.

Loren Feldman:

You were in the program for 13 weeks, both you and Luis, your partner. How did the business do while you were in the accelerator?

Hans Schrei:

There was a lot of stress. It was like having two jobs, frankly.

Loren Feldman:

You were still trying to run the business at the same time. You didn’t delegate that?

Hans Schrei:

I mean, there was no one to delegate it to. So we did slow down on like all new launches and that type of thing, because the focus was here. So we automated as much as we could, I guess. But yeah, it was like having two jobs.

Loren Feldman:

And were there performance issues?

Hans Schrei:

No, no, I mean, not really. Because at the end of the day, you are working on things that are related to the business. So you’re looking at the most urgent things first. So that really helped, and getting perspective really helps.

Loren Feldman:

I think you said earlier that one of the things you most wanted to get out of this experience was to learn an approach to funding that would work for you. I’m curious whether you feel you came away with a clear vision of how you want to approach that, going forward?

Hans Schrei:

So one of the exercises that I’ve never even thought of doing was the equity cascade for successful rounds. So like, of course, you say, “As a founder, I would rather have 20 percent of a $100 million company than I want to have 100 percent of a $1 million company.” That makes sense. That’s $1 million versus $20 million.

The problem is that you’re not the only factor in this ecosystem. So by the time you are holding just 20 percent of your company, you’re also looking at you’re not really being in control of your destiny anymore. And that is a part of it that is normal, but it’s a type of thing that you want to really ask yourself, “Is this where I want to go? Is this something that I will be comfortable doing down the line or not?”

Loren Feldman:

So did that experience change your view of where you’d like to fall on that continuum, in terms of how much of the business you control?

Hans Schrei:

I think it didn’t change it, but it did give me a more nuanced perspective, I would say. But down the line, at some point, you’re gonna lose control, most likely. If you really want to grow, you’re gonna lose control. And that is fine. But you want to lose control at a point when you have proven yourself and when you have options.

Loren Feldman:

Did you have any kind of demo day at the end of it? Did this lead up to you pitching to potential funding sources?

Hans Schrei:

Yes. That was last Tuesday.

Loren Feldman:

How’d that go?

Hans Schrei:

It was a lot of fun. You know, even that is a learning experience, because there’s a lot to be said about knowing your audience. It was fine. I wouldn’t say that it was not successful, like our own pitch, but I think it would have been way stronger had we asked ourselves the question: Who is gonna be listening to this? And we really didn’t.

So we had this amazing presentation. It was beautiful. We talked a lot about our mission, about our brand. We didn’t really talk much about the financials, which makes sense in certain contexts. I’m not sure it made sense there. But frankly, I would have liked to do this knowing who I was pitching, and I didn’t. So that was on me for not asking, frankly.

Paul Downs:

If you’re selling anything, knowing who you’re selling to is pretty basic. We deploy all kinds of different playbooks, depending on who we’re speaking to.

Hans Schrei:

Yeah, absolutely. The nice thing about this is that this is a controlled environment. All the people who we were in front of were within the ecosystem. So you kind of have a little taste of the real world, if you will. So yeah, that was a mistake. That was a mistake, but you learn. I can promise you, that mistake won’t happen to me again

Loren Feldman:

It seems like the kind of thing that they might have coached you on. I’m surprised they didn’t give you a better feel for that.

Hans Schrei:

This is the thing. You wish you would go to an accelerator, and they’re going to tell you, “Oh, this is what you have to do.” That is not how it works. What’s going to happen is that you’re gonna get exposed to a ton of different perspectives. And, of course, you get coached, and you get some direction. But for the most part, it’s also about you being able to walk through that the same way that you would do in real life.

Loren Feldman:

Shawn, I think you told us about going through a program that EO offers fairly early in your journey. What was it anything like this?

Shawn Busse:

I think considerably different. I mean, for context, I did this in the end of 2009. I think it might be called EO Accelerator. But it’s a really structured—or at least the way it was run then—it was a really structured curriculum. It was designed as a three-year program to get your company up to a million dollars in annual revenue, and you had to be at least $250,000 a year in sales.

So a very, very different thing. There was no investing component to it. And because it was a three-year program, it was pretty in-depth around each of the different areas of the business. I had been running the business for nine years, by the time I joined it, but I really didn’t know anything about business. So I really wasn’t living up to our potential, and the accelerator program really unlocked that potential for us. That’s when we saw really considerable growth year after year.

Loren Feldman:

Is there something specific you would point to that unlocked that potential for you, that you got out of it?

Shawn Busse:

I mean, a lot of it was being exposed to how to think about a business, how to look at finance, how to look at your operations, how to look at culture, hiring, just a lot of fundamentals that I was never exposed to. And then I would say the most important part was strategy and business valuation. So I focused a lot on what made a business worth something and really built the organization around that—things like recurring revenue as opposed to project revenue, things like low turnover of employees, things like higher value customers that valued you for what you did, as opposed to transactional relationships. So a lot about strategy, in that case.

Loren Feldman:

Paul, I don’t think there were accelerator programs when you started your business, but you’ve spoken here about how you feel it was a real turning point for you when you started getting some outside perspective on your business, in part from participating in a peer group setting like Vistage.

Paul Downs:

Yeah, well, it was a turning point, but it was 26 years after I started.

Loren Feldman:

So you survived 26 years. Do you think an accelerator of some sort would have been of interest to you, had it existed back then?

Paul Downs:

Absolutely. Although I was probably too dumb to realize the value of it. But I would say that, for anybody who’s trying to start a business, just getting out of your office and talking to more people is almost always worth doing. And we just saw that when we all went to Chicago a couple of weeks ago, but you will meet people who know more than you. And if you’re smart enough to listen to them, it’s going to open up worlds of new information, plus building a network of people you can call to help you.

And I think it’s very, very difficult, particularly these days, to even imagine someone succeeding without building a network, reaching out, making use of the ease of connection that we’ve been blessed with. And so I think that these things are great, and I definitely would have done it.

Read Full Podcast Transcript Here

.png)